Arbitraging in Your Own Liquidity Pool: How to Make Money on Someone Else’s NFTs

In October, we reviewed a test version of a marketplace where NFTs can be traded via liquidity pools. Only three test collections were available on ArtDEX at the time. Today, the marketplace is operating on the mainnet, so we decided to take another look at the exchange of unique tokens.

This post discusses some popular collections, compares their prices with OBJKT, and looks into making money from providing liquidity to the marketplace.

What Is Traded on ArtDEX: Devils, Dogs, and Otters

ArtDEX is an exchange for trading NFTs. For each collection, users create liquidity pools and put NFTs and tez into them. Other users can buy NFT in the pool for tez or instantly sell their token from the same collection there.

When buying NFTs, the price in the pool goes up. When selling them, it goes down, just like in regular AMMs similar to those on SpicySwap and QuipuSwap. But users can choose which token they want to buy: the cheapest or a specific one from the pool.

You can read more about it all in our past review. Since ArtDEX was launched, users have already traded over 5,000 tez.

All popular Tezos collections are now traded on ArtDEX: MU, Dogami, Ottez, Tezzardz, Degen Foxes, and others. You can do arbitrage with them: buy cheaper on other marketplaces and sell higher on ArtDEX, or vice versa, buy on ArtDEX and sell on OBJKT. The difference between popular collections is small, but it exists nonetheless.

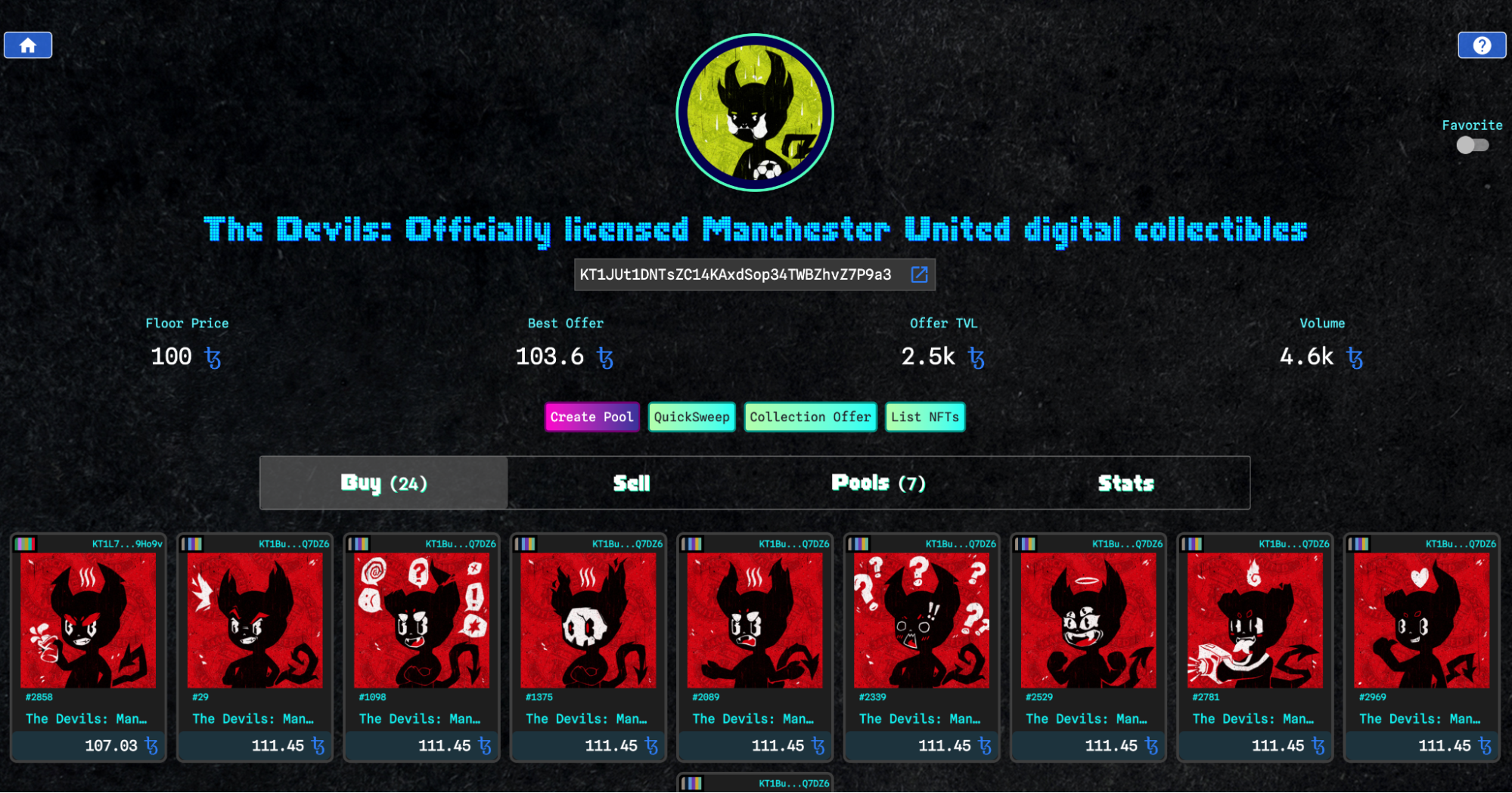

The Devils: Officially licensed Manchester United digital collectibles

A collection of black and red devils from Manchester United, starting at 94.9 tez on the secondary market. On OBJKT, the cost per NFT starts at 100 tez. It is worth considering a commission of at least 3.5%, depending on the pool chosen.

The total sales volume is 4.4 thousand tez, i.e., $3,350.6 at the time of writing.

DOGAMI

A series of 3D dogs from the augmented reality mobile play-to-earn game Petaverse, which shares the name with the series. The minimum aftermarket price per virtual tail is 108.1 tez, and total sales are $397,274.55, which is 521.7k tez. On OBJKT, it will be more expensive at 109 tez.

The minimum commission in one of the pools is 4%.

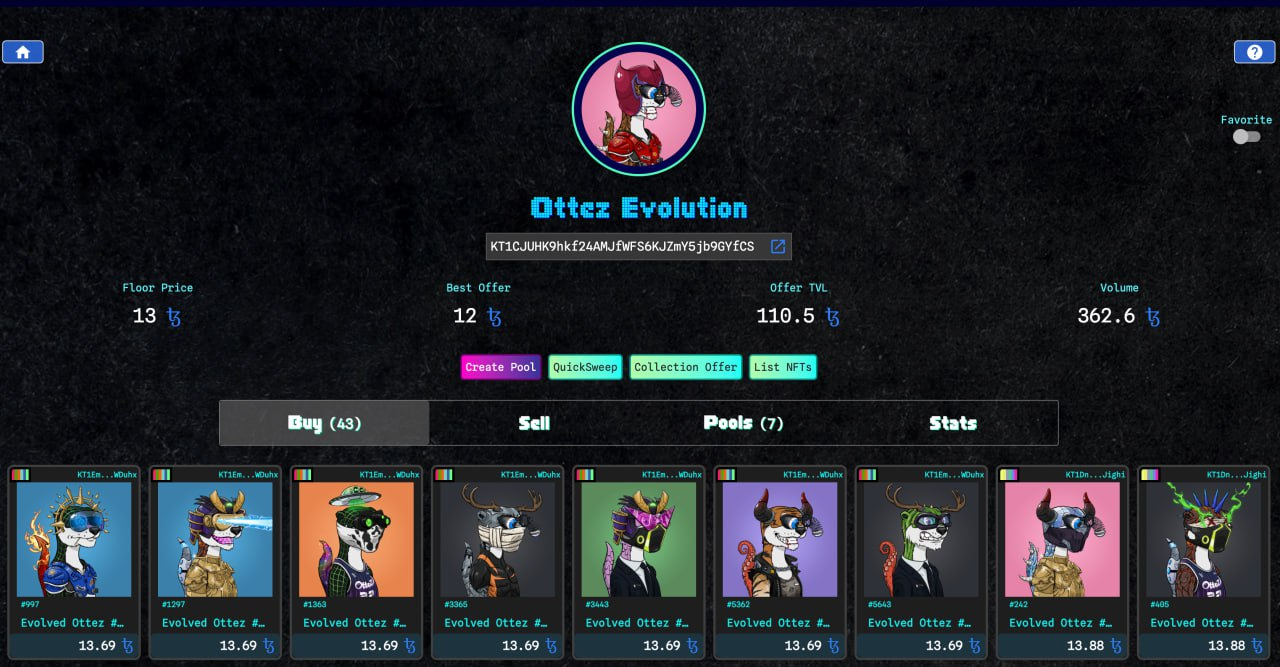

Ottez Evolution

The dressed hipster otters fetched collectors around $276,119.90 or 362,600 tez. At least one “card” can be purchased for 13 tez on ArtDEX, which is almost 2 tez cheaper than on OBJKT. There are seven pools available, with commissions starting at 2.5%.

How to Earn From Liquidity Pools and Arbitrage

We have explained the process of creating pools in simple terms. SalsaDAO’s guide is also advisable.

ArtDEX consists of many pools. Users create them: they choose a pool type, configure trading parameters, and contribute the initial liquidity in the form of NFT of one collection and the corresponding number of tez.

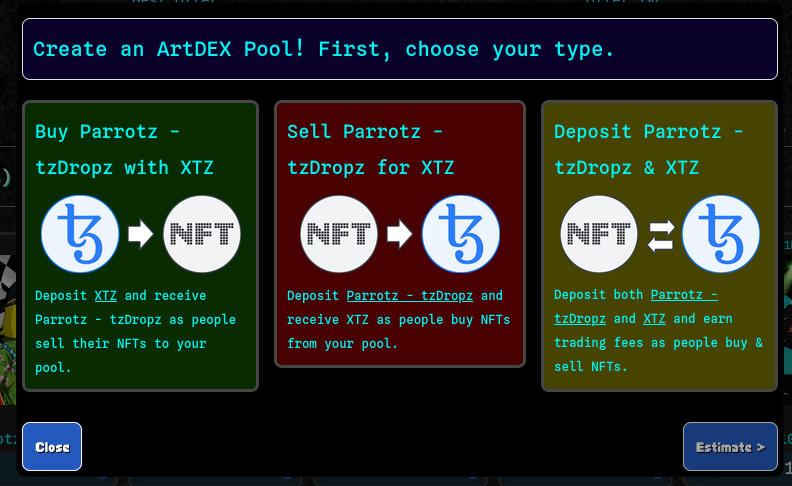

The pool type determines the type of liquidity the creator provides:

- Buy Parrotz: the creator contributes tez, other users contribute NFTs to the pool and withdraw tez;

- Sell Parrotz: the creator contributes NFTs, other users contribute tez to the pool and withdraw NFTs;

- Deposit Parrotz: the creator contributes both NFTs and tez, other users make trades in both directions.

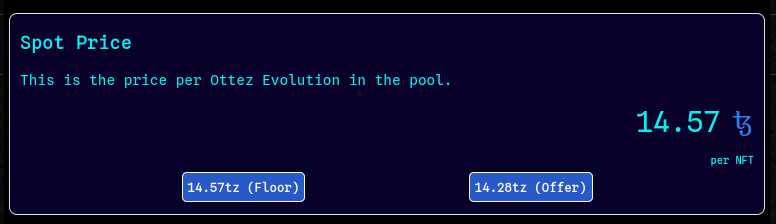

When setting up the pool, you must set the initial token price (the spot price) and the bonding curve parameters. If the collection is already traded on ArtDEX, it will offer the spot price itself. Otherwise, you need to specify it.

When trading through our pool, the spot price determines the buy/sell price. The “Buy Parrots” pool equalizes the final selling and spot prices. The “Sell Parrots” pool ensures the buy price will equalize the spot price, depending on the adjusted curve.

The buying price must always be a notch higher than the delta to avoid abusing transactions with arbitrage. We recommend setting an initial spot price roughly the same as on external trading floors.

An alternative option is to issue a collection on ArtDEX. If we create the NFT ourselves directly on the marketplace, the value of such tokens will be the base price, which excludes the possibility of arbitrage on other marketplaces.

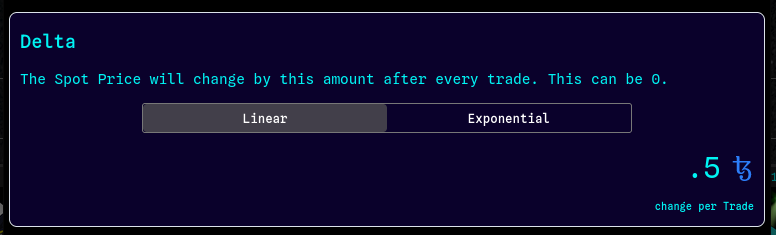

The final step is setting up the pool’s curve and trading commissions. These parameters are needed to measure the spot price after each past transaction. There are currently two types of curves available on ArtDEX, with additional options in development:

- linear curve: changes the value by a given amount of tez after each order execution;

- exponential curve: changes the price by a given percentage after each trade.

After buying NFTs in the pool, the spot price will increase, and when selling, it will decrease. With each transaction, users will pay the pool creator a trading commission. The marketplace recommends setting commissions closer to 1-2% overall and 5-15% when a new collection is released on ArtDEX.

Binding curves are critical on ArtDEX. They ensure that NFTs have continuous liquidity in the pools and help them respond to changes in the market without user intervention.

Let’s say Alice wants to deal with providing liquidity to TU’s NFTs at a price of 40 tez. This is the price she chooses because, in external markets, the approximate price of a unique token is 40 tez.

The project releases news about fundraising, and the value of NFT rises to 60 tokens apiece. Without a binding curve, the pool cannot change the value according to the new price. This means that TUs will continue to sell for 40 tez in Alice’s pool, while other users will buy tokens from the collection in Alice’s pool on ArtDEX and resell them at an inflated value on other exchanges.

If Alice chooses a linear curve and a delta of 10 tez, the token’s value will update in two transactions.

The interplay of binding curves, spot prices, and external NFT markets create the possibility of securely receiving additional trading commissions from arbitragers’ trading on different marketplaces.

Conclusion

Passive income from any way of providing liquidity on ArtDEX is an excellent opportunity. Even FounderJabba himself makes some money this way and tweets about the success of arbitration with a commission of only 2.5%.

Creating your own liquidity pool on ArtDEX is fast, simple, and profitable. Give it a try if you haven’t done already.