A Review of Signum.loans: How to Loan Some Tez with NFT as Collateral

On 1 October, Signum launched on Tezos. There, you can borrow tez against NFT collateral, just like in a pawnshop.

This post discusses how loans on Signum work, how to use it, and how popular they can become.

What Is Signum’s Offering

Signum is a platform of standardised loans collateralised by NFTs. It works as follows: Alice creates an application for a tez loan and deposits her NFTs. Bob accepts her offering and gives Alice his tez. If Alice repays Bob his tez and interest within the agreed term, everyone’s happy. If she fails to do so, she keeps tez, but Bob takes her NFTs.

The platform may seem complicated to regular users. Whereas with loans like Yupana’s you lend assets against popular tokens with known market rates, with Signum you have to consider whether you can sell the collateralised NFT and cover the loan amount in case the borrower fails to repay it.

Signum is not only interesting for borrowers, but also for the lenders themselves. They can buy potentially valuable tokens at a discount or simply make easy money if the borrower fulfils their obligations.

How to Take Out a Loan on Signum

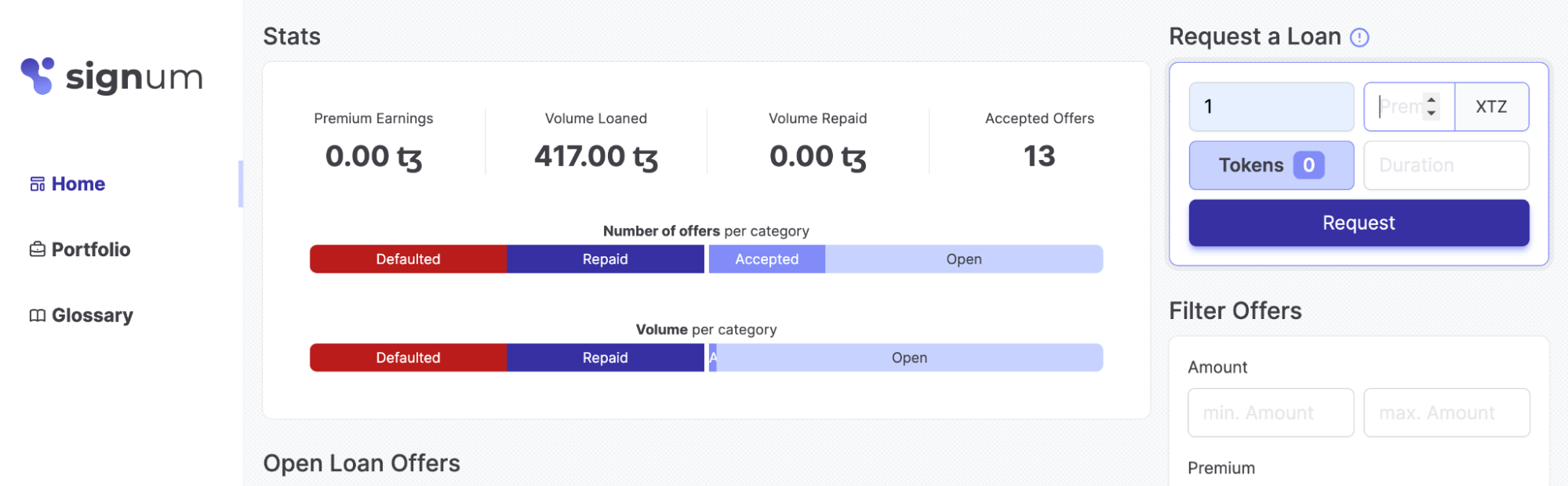

You would need to fill in the Request a Loan form in the upper right corner.

In your application, specify the loan amount, the desired interest, the duration of the loan, and select your NFTs for collateral. Then confirm the operation in the linked wallet and pay the transaction fees.

Signum now accepts any NFT. The loan amount does not depend on the market value of the token or collection, but only on the lenders’ willingness to lend specifically against that token.

The collateralised NFT is transferred to a Signum smart contract. The token will be locked until the potential borrower cancels their application, or until they repay their loan.

How to Issue a Loan on Signum

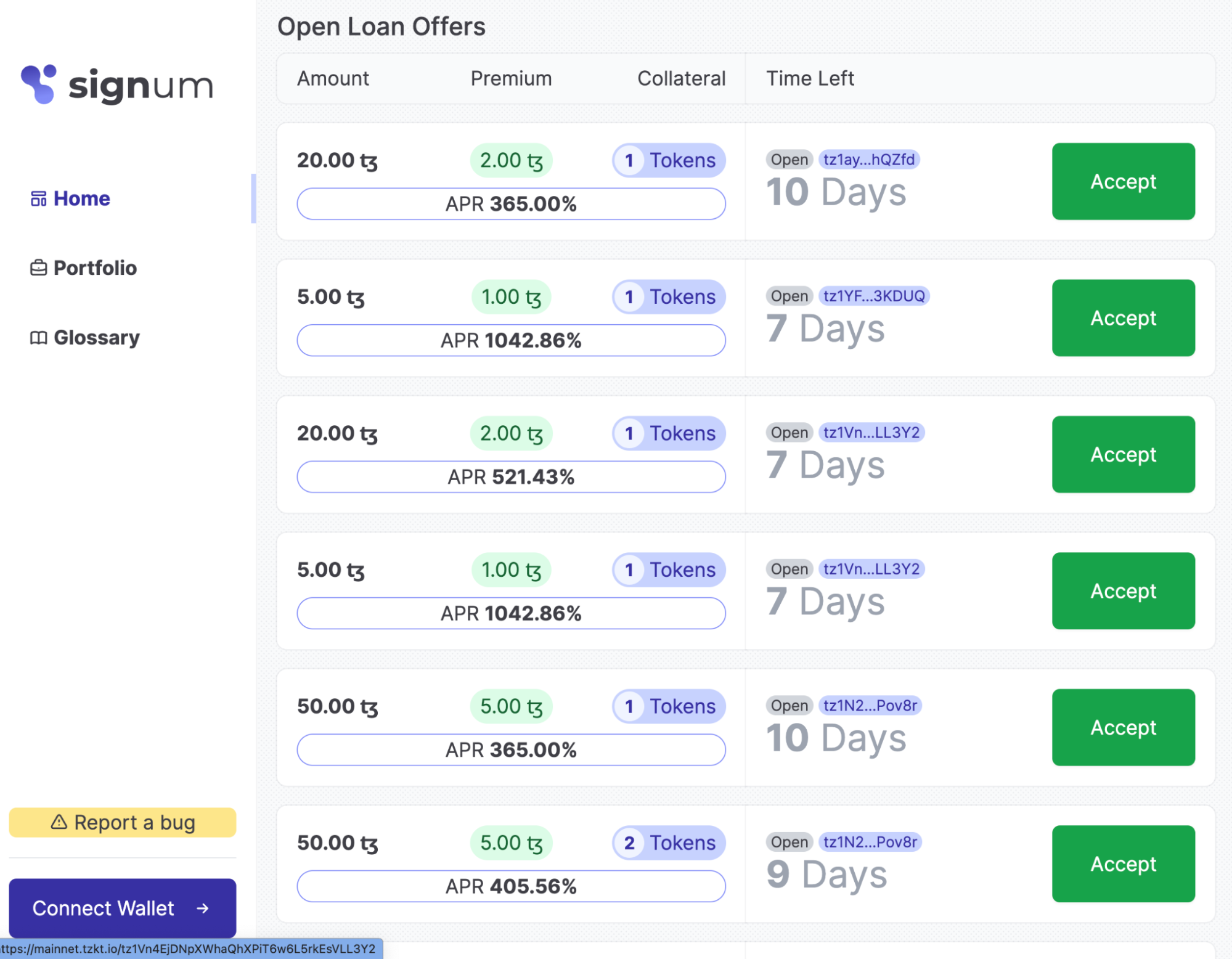

In the website’s central part, there is a table with borrowers’ applications. You need to connect your wallet and click Accept against the application you want to use.

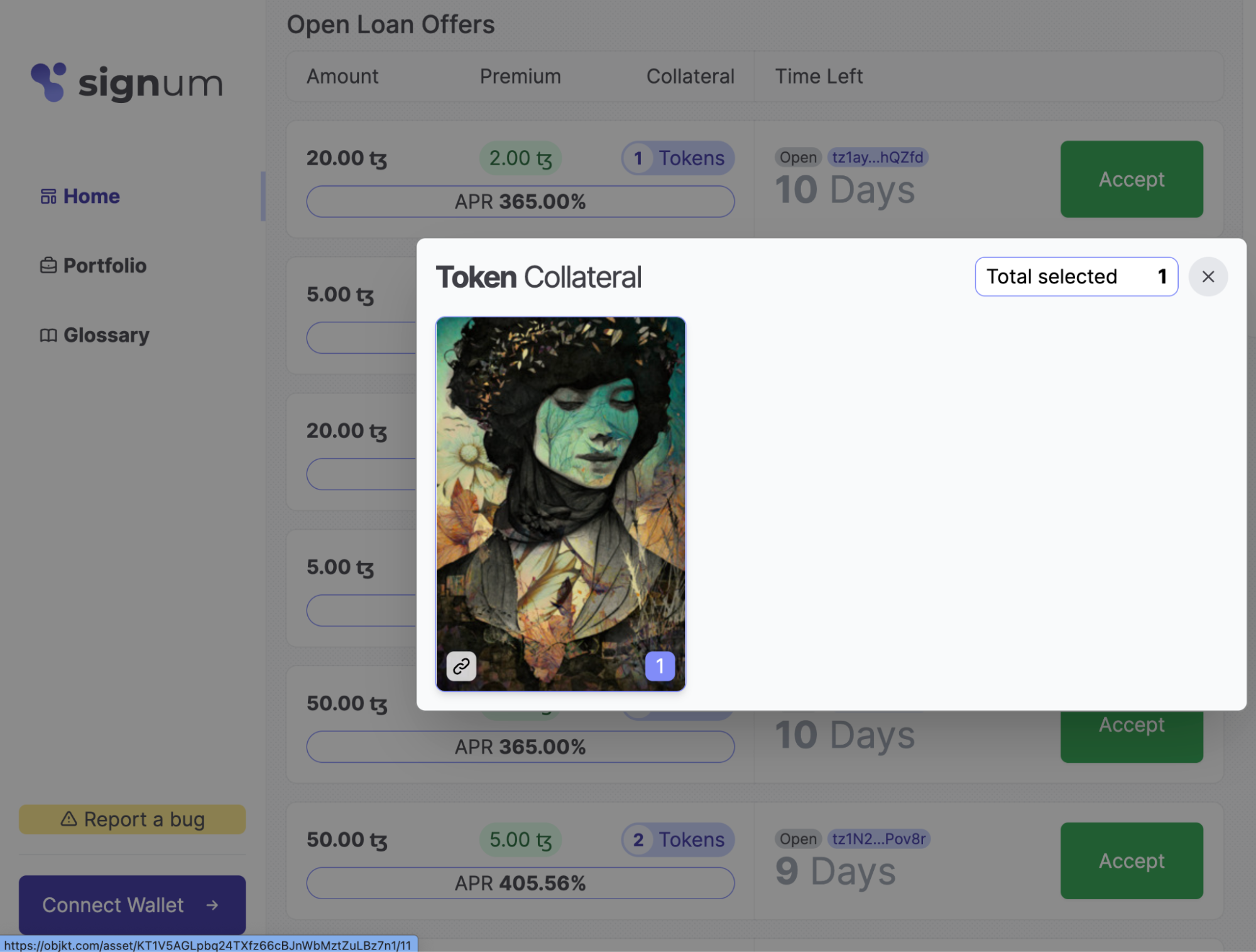

Before the loan is approved, check out what NFTs are in fact offered. To do that, click on the blueberry-coloured button Tokens just above the APR data.

Then a window with the token preview will open. There is a link icon that leads to the NFT page on Objkt.com, where you can see price and activity of specified token. We checked several offers: most often the loan amount corresponds to the price the owner is asking for the NFT on the marketplace. There are some exceptions, though: one user wants 20,000 tez against tokens that are clearly worth less than 100 tez in total.

Once the loan is approved, all that remains is to wait for the borrower to fulfil the obligations or default on them.

How Popular Are Loans Collateralised by NFT?

According to tzkt.io and Signum’s own stats, over the three days since the platform has been in operation, there were 417 tez deposited from honest applications for nearly 2k tez. A decent result.

We also decided to check the popularity of similar platforms on other blockchains. One of the largest platforms of this kind, Arcade.xyz, reports $25 million in transactions. Meanwhile, the largest loan there was $4 million.

According to DeFiLama’s statistics, the volume of NFT-backed lending services is about 5% of total transactions in popular blockchains. It turns out that NFT loans are quite a popular service, and are frequently used.

Given the popularity and quality of NFTs on Tezos, loans can help major collectors free up some funds to work with DeFi or do more flipping. Yet, there is a problem: a cosmically high APR. The lowest borrowing rate is 40% APR, and in similar protocols on other blockchains the situation is quite similar.

Hopefully, supply and demand will stabilise so that both borrowers and lenders will benefit from Signum. We wish the project success and will keep an eye on its progress.

Subscribe and never miss updates from the world of Tezos:

- Telegram channel

- Twitter in Russian and Ukrainian

- Twitter in English

- YouTube channel

- hub at ForkLog