InstaDEX: Provide Liquidity Without Risking Impermanent Loss

Last week, the Instaraise project launched private testing of the decentralized exchange InstaDEX. Its main features and primary differences from other DEXs on Tezos is the provision of liquidity in one token and insurance against impermanent losses.

This post explains how InstaDEX works and what problems it can solve.

Liquidity Provision in Just One Asset

Liquidity pools are the backbone of a DEX. They are smart contracts that store two assets and allow you to exchange one token for another.

Liquidity pools are filled by liquidity providers, i.e. projects, whales, and ordinary users who want additional income in the form of trading commissions. They contribute two assets in equal value to the pool, for example, 1 tzBTC and 19,000 kUSD or 1,000 QUIPU and 250 tez. In return, liquidity providers receive LP tokens, which represent their share of the total number of assets in the pool.

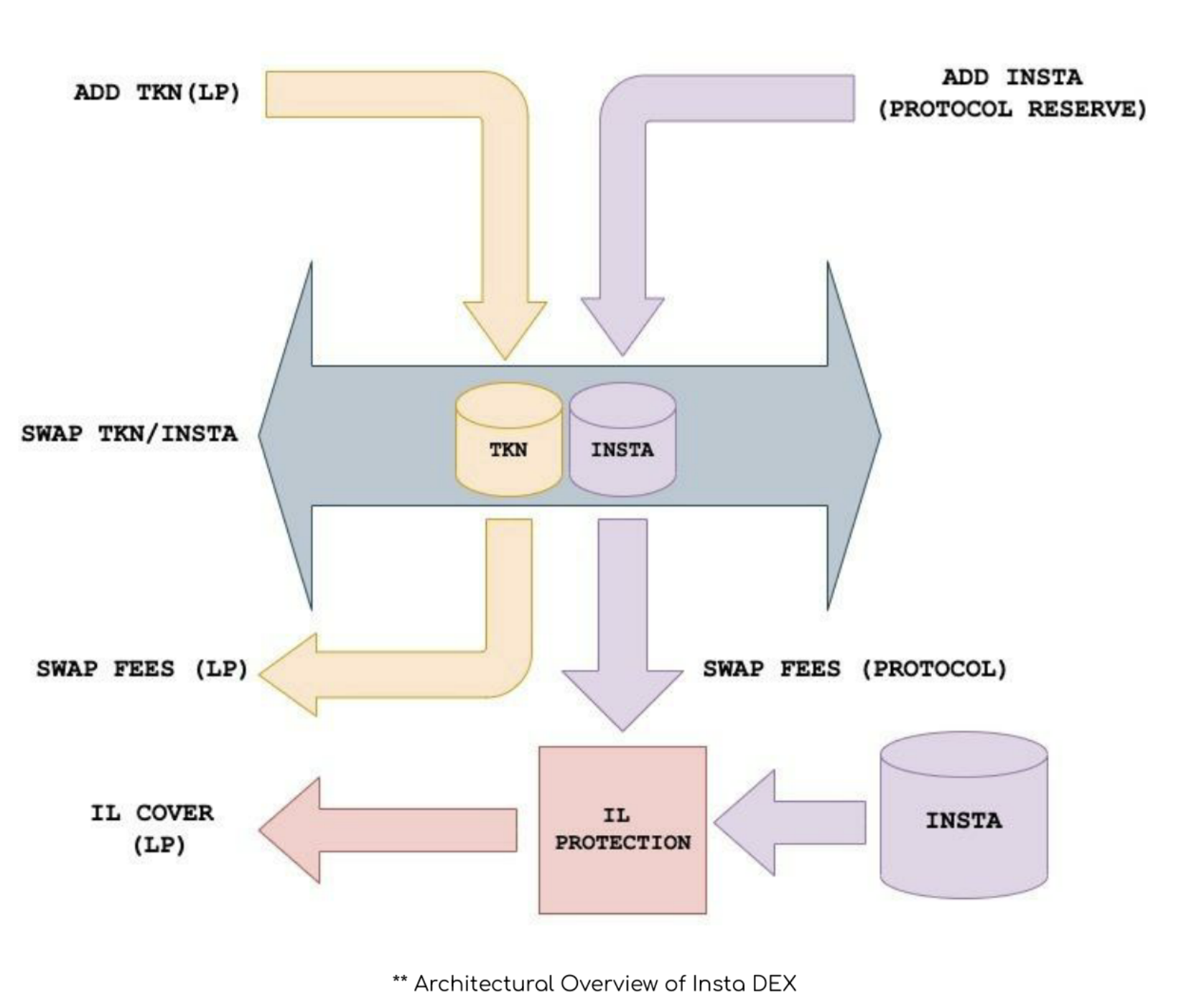

InstaDEX will use the usual liquidity pools, but with a condition: all pools will work with the INSTA project token. That is, InstaDEX will not have pools like tzBTC/kUSD, but only tzBTC/INSTA, kUSD/INSTA, and so on.

Providing liquidity in one asset will work like this:

- The user contributes tzBTC to the tzBTC/INSTA pool.

- InstaDEX deposits an equal amount of INSTA tokens.

- The user and InstaDEX split the resulting LP tokens and trading commissions in half.

With these mechanics, liquidity providers won’t have to exchange some of their tokens for others to earn commissions.

At the same time, users will be able to contribute INSTA tokens to liquidity pools to receive LPs, as well as create new pools with the initial liquidity contribution in INSTA and another token.

Impermanent Loss, the Plague of Liquidity Providers

When a liquidity provider wants their tokens back from the pool, they burn LP tokens in the pool and get the assets back. Still, the pool returns not the original liquidity and earned commissions but a corresponding share in the pool at the current rate.

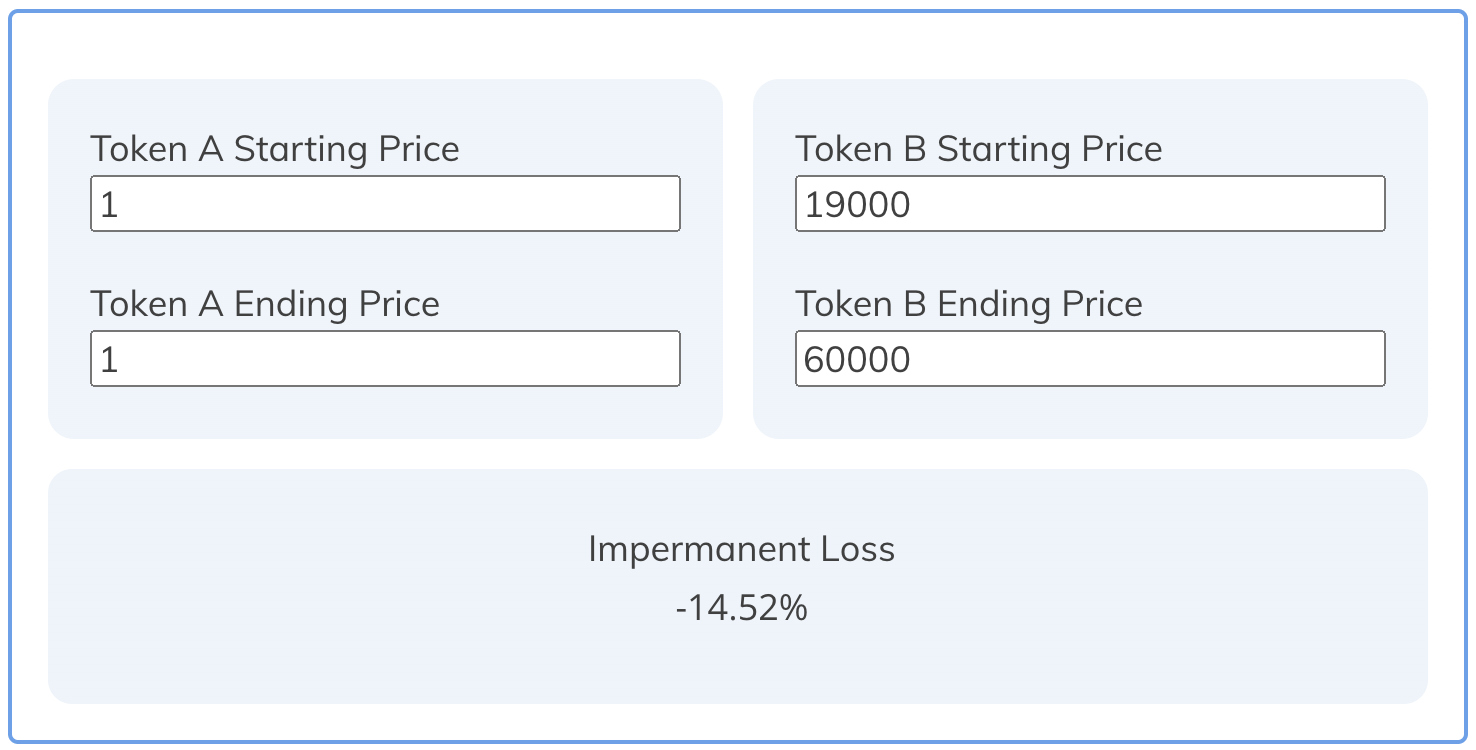

Let’s say the provider contributed 1 tzBTC and 19,000 kUSD to the liquidity pool. If the price of bitcoin rose to $60,000, their share would be 33,673 kUSD and 0.532 tzBTC worth a total of $65,593. Yet, if they had not contributed liquidity to the pool, their portfolio would have been worth $79,000. The underperformance is 14.5%, which is the ipermanent loss in question. You can see it for yourself in an online calculator.

InstaDEX offers insurance against impermanent losses. For each day of liquidity retention in the pool, InstaDEX insures 1% of potential impermanent losses. With liquidity retention for 100 days, the provider is fully protected and InstaDEX will compensate their losses from the profit they make from INSTA investments in pools, or from the reserves in INSTA. The insurance itself does not become effective until 30 days after liquidity is deposited.

In general, it will look like this:

- Alice contributes tokens to the pool, and InstaDEX contributes INSTA for the same value.

- Bob and Eve trade in the pool, and the pool earns trading commissions.

- Alice gets half of the commissions, and InstaDEX gets the other half.

- InstaDEX saves a portion of the trading commissions to the impermanent loss insurance fund.

You can check out the details in the InstaDEX Litepaper.

Conclusion

InstaDEX can solve the problem of token hodling on Tezos. An investor buys tzBTC with the goal of holding it for a year or two, deposits it in the InstaDEX pool, and gets additional profits from trading commissions without the risk of underperforming due to impermanent losses. This is more profitable than just holding BTC and less risky than using leverage.

There are two sides to using token/INSTA type pools:

- InstaDEX will need to add a liquidity router so that users can swap some base tokens for others without manually buying INSTA;

- The lack of token/token pools will lead to a higher token liquidity concentration and a lower slippage in exchanges.

All in all, we’ll wait for InstaDEX to launch on the mainnet to give those assumptions a reality check.

Subscribe to Tezos Ukraine on social media and never miss a thing from the world of Tezos!

- Telegram channel

- Twitter in Russian and Ukrainian

- Twitter in English

- YouTube channel

- hub at ForkLog