Plenty.network: What to Do With PLY and veNFT and How to Earn on Them

On Wednesday, the Plenty.network protocol launched its first voting for liquidity pools with veNFT.

What is veNFT, where to get them, how to vote for pools, and in what tokens will the rewards be paid out? This post explains everything that liquidity providers on Plenty.network might need.

How Plenty.network Works

The backbone of Plenty.network is liquidity pools. Providers contribute assets to the pools, and traders use that liquidity to exchange funds.

In conventional DEX, pool providers make money in two ways:

- commissions: traders pay trading commissions for each trade. When the liquidity is withdrawn, the provider takes its share of the commissions collected;

- farming: when depositing liquidity, a provider receives LP tokens representing their assets in the pool. LP tokens can be put into a farm and thus bring additional profit.

In addition to the usual LP tokens, Plenty.network has two other assets that affect earnings: PLY and veNFT.

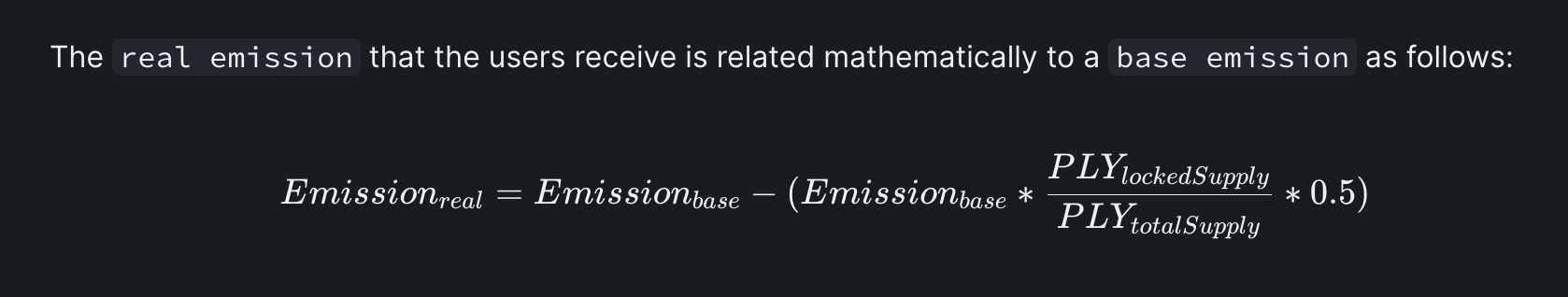

PLY is a native Plenty.network token. The provider locks its LP tokens into a gauge contract (gauge) and receives regular rewards in PLY. The emission depends on the number of PLYs blocked in veNFT.

veNFTs are NFTs that the user receives for blocking PLYs for a certain period. VeNFTs are needed to vote for pool gauges and receive the trading commissions accumulated therein. In doing so, veNFTs gradually lose their “weight,” but their holder automatically receives a portion of the PLY issue to protect against inflation.

The goal of these Plenty.network mechanics is to provide the protocols with liquidity in the long term.

How to Earn on Plenty.network

The first way is to add liquidity to the pool, block the LP tokens, and receive rewards in PLY.

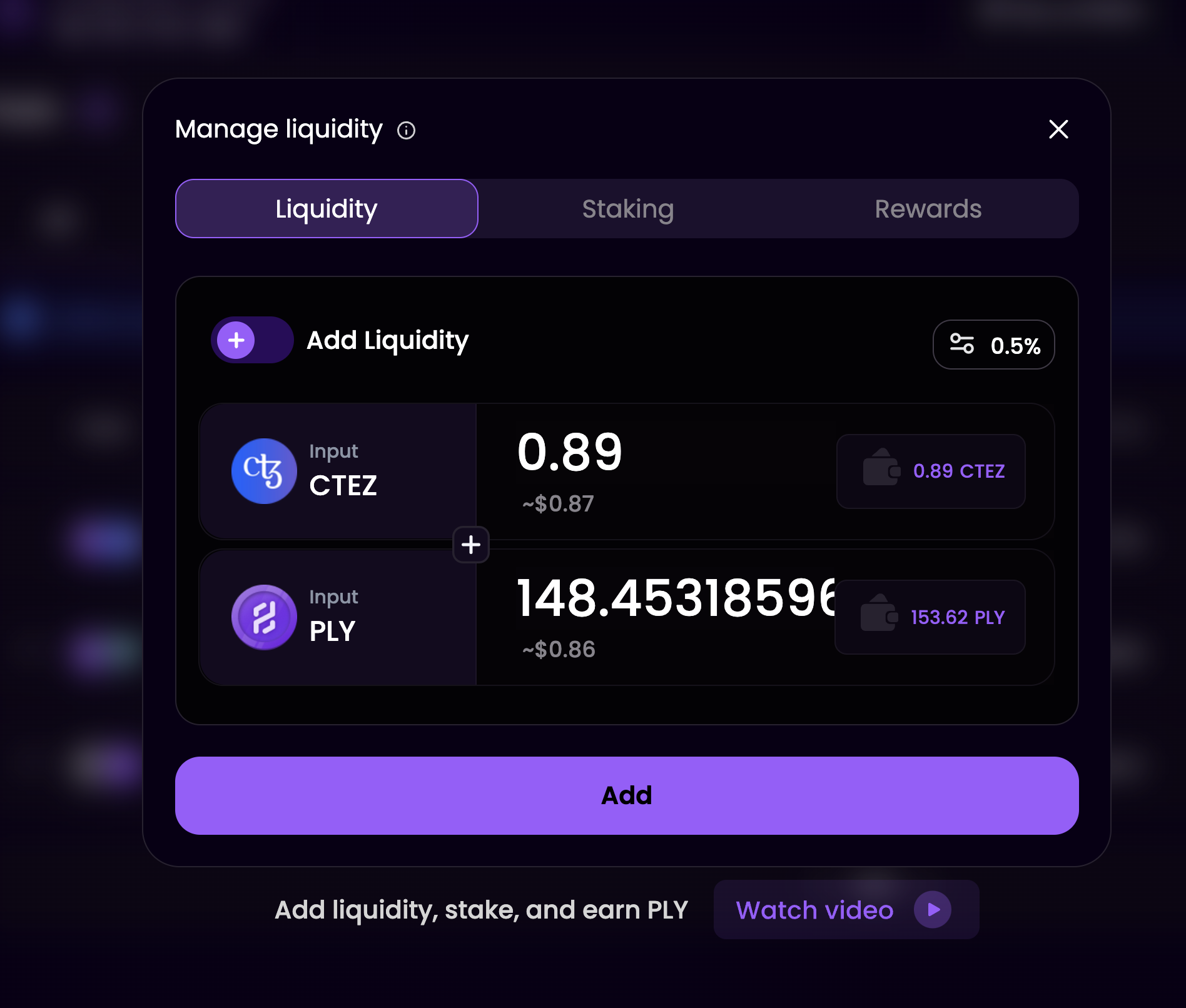

To do this, select the needed pool on pool page, click Manage, and confirm the liquidity deposit. You will receive PNLP tokens in your wallet.

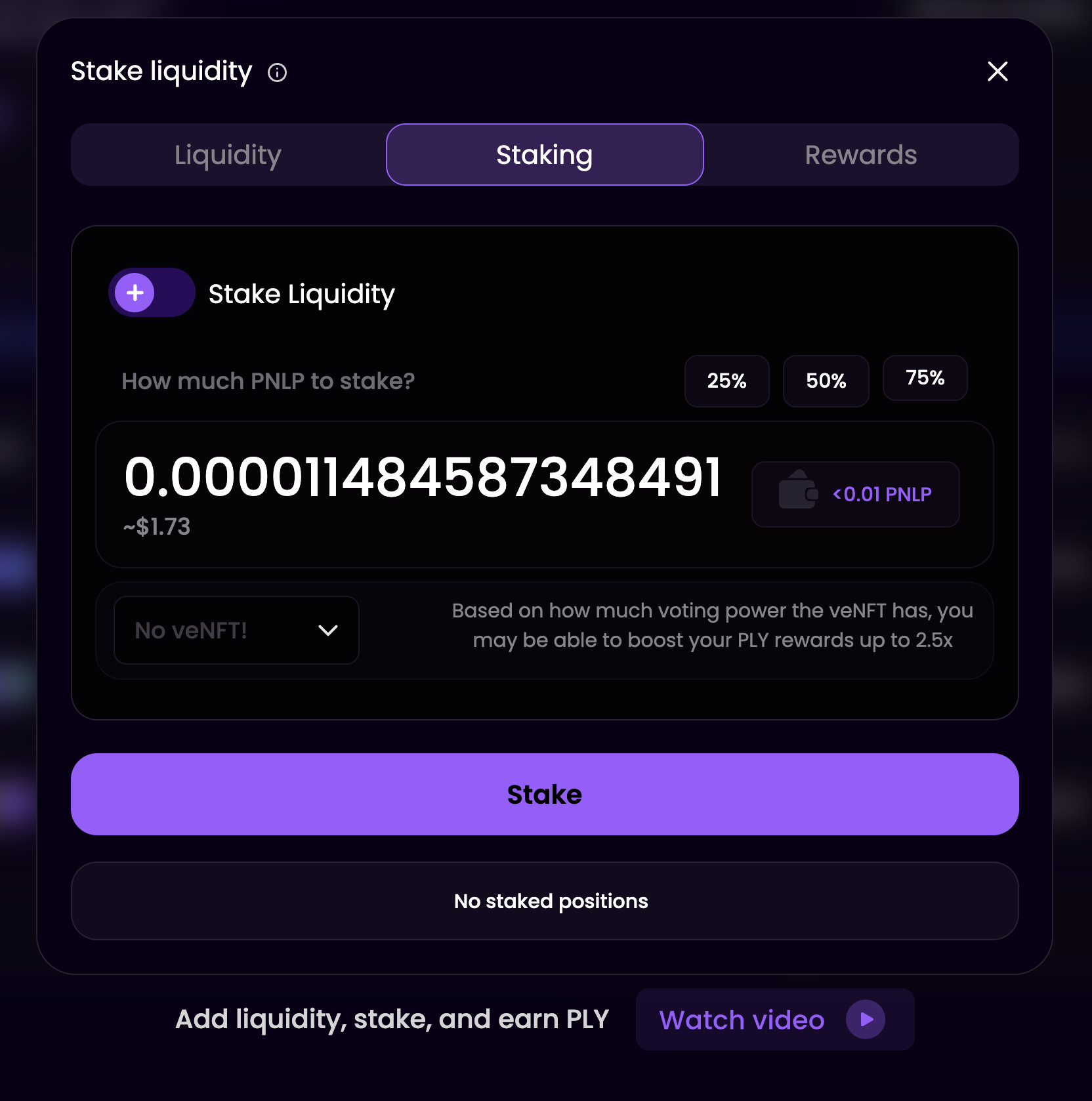

Then go to the Staking tab and deposit PNLP.

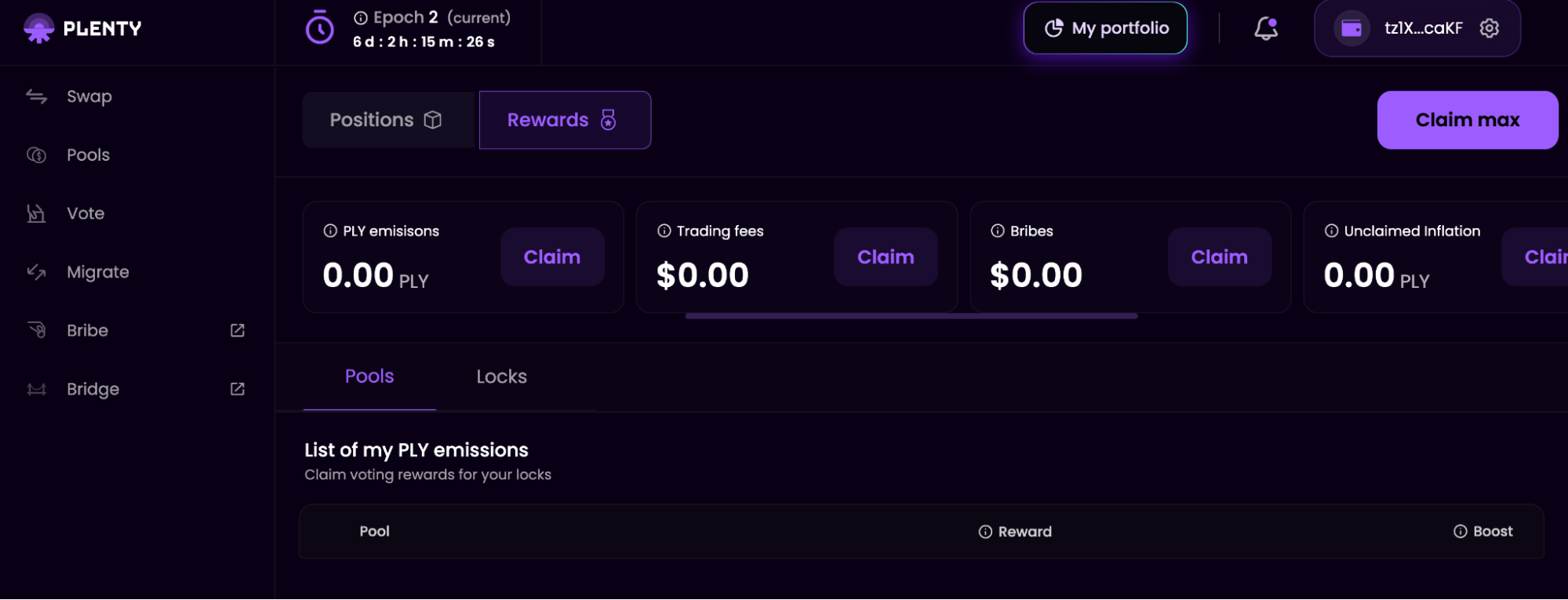

In the Rewards tab, rewards in PLY will be displayed on the My Portfolio page. You can collect them there too.

The next step is to vote for a pool to receive its trading commissions. You can vote for any pool, not just the one you have contributed liquidity to.

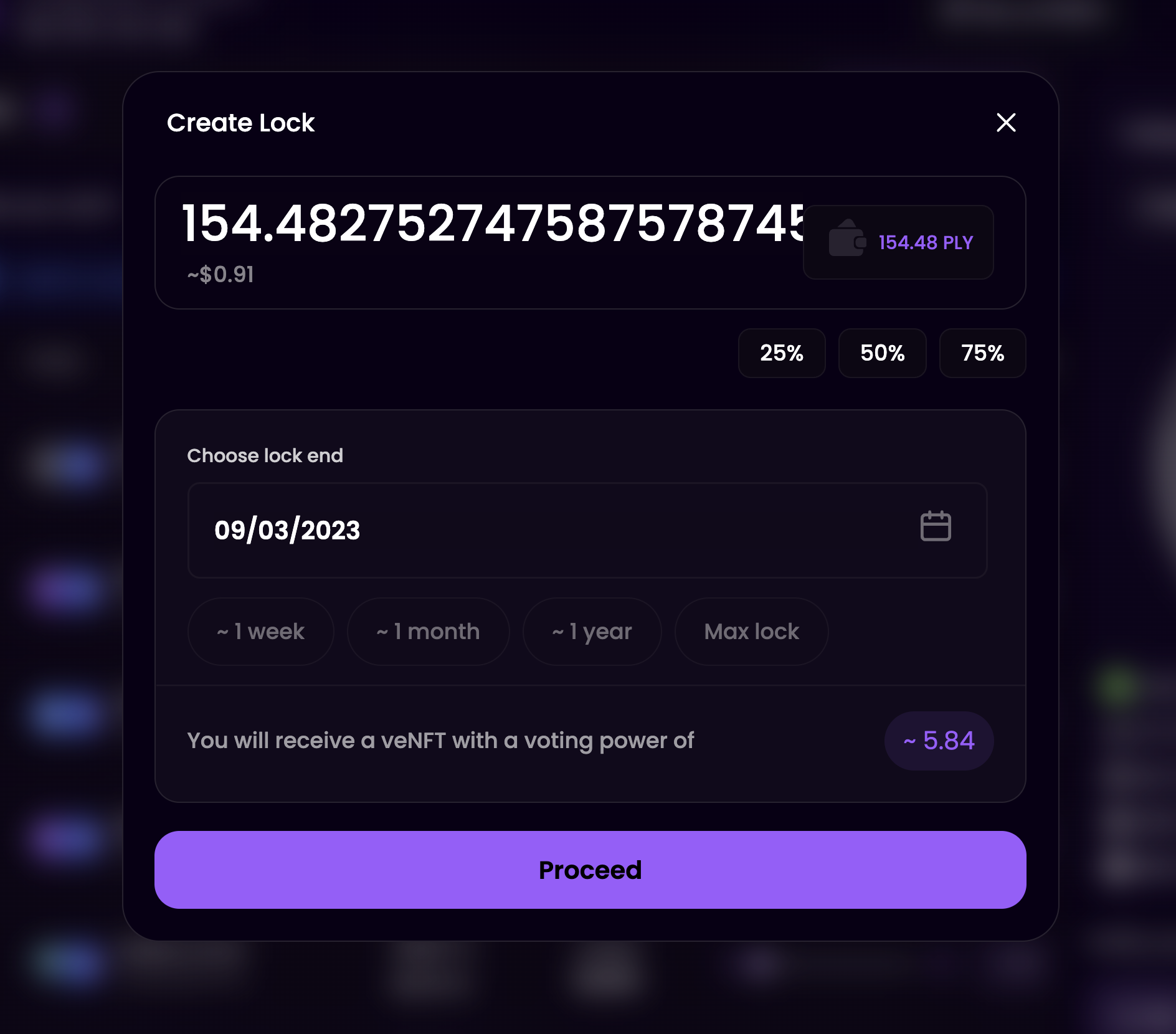

First, you need to get veNFT. You can buy them at OBJKT or get them via PLY blocking. To do this, click Create Lock on the Vote page and specify the amount and term of the PLY lock in the menu that opens.

The veNFT voting power depends on the duration of the block. For example, blocking 154 PLY (~$1) for a week will produce a veNFT of 1.39, while blocking for 4 years will produce a veNFT of 153.39. Fundamentally, it works as follows:

- blocking for 4 years (maximum): 100% voting strength;

- blocking for 2 years: 50% strength;

- blocking for 6 months: 12.5% strength;

- blocking for a week: 0.4% strength.

After confirmation, you will receive a veNFT of the appropriate color:

- green: one week to one year;

- red: one to two years;

- purple: two to three years;

- red: three to four years.

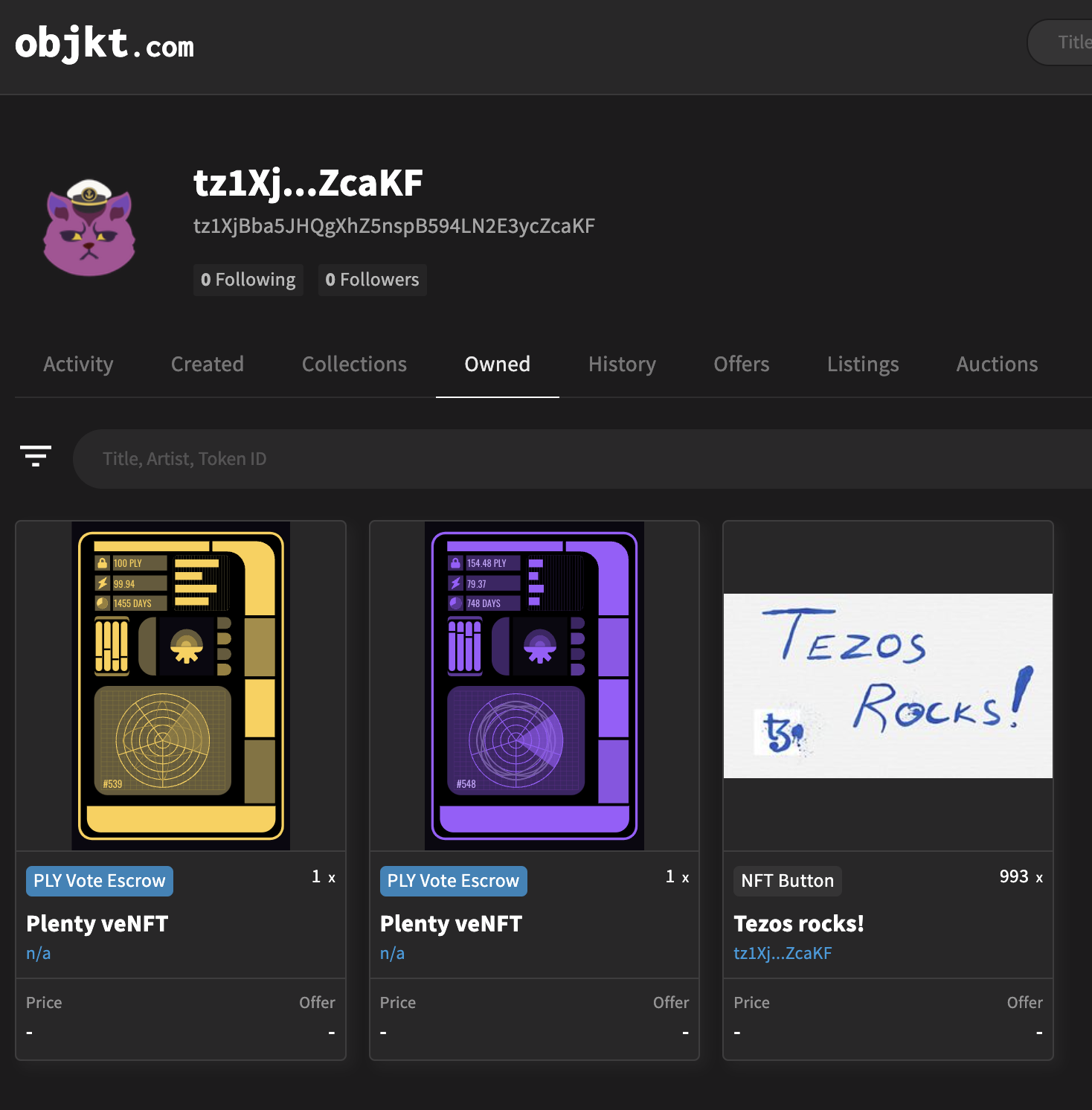

It’s a pity, but veNFTs are not displayed in Temple Wallet. Still, they can be viewed on OBJKT.

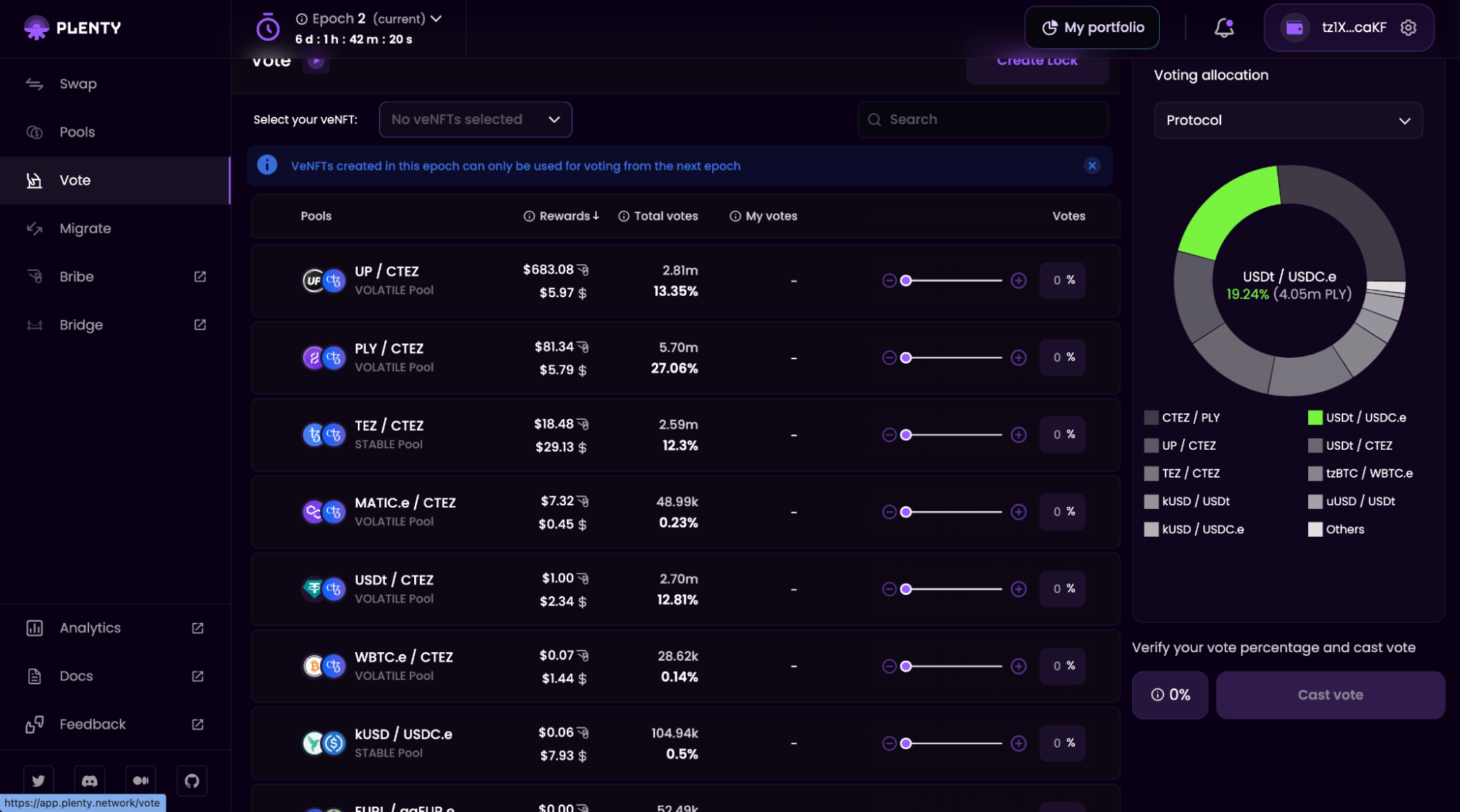

You can’t vote immediately: you must wait for the next epoch, up to 7 days. When it starts, select the pool in the diagram on the right or in the list in the center, add votes and confirm the transfer of veNFT.

The amount of rewards in the given era is indicated beside each pool. The top number is the bribe that any user can attach to the pool to increase its appeal. In the UP/ctez pool, the bribe is $682 in UP. This money will be shared by users who voted for the pool. The lower number is the accumulated trading commissions in the pool.

Conclusion

Plenty.network supports three ways of earning:

- deposit liquidity, lock in a PNLP, and earn PLY;

- block PLYs in veNFT or buy a ready-made veNFT, vote for the pool and earn trading commissions;

- deposit liquidity, get PLY, lock them into veNFT, vote and get commissions, reinvest them into the pool, get more PLY, lock them into veNFT with more voting power, and so on to gradually earn more and more.

Long PLY locks, adjustable PLY issuance, focus on earning trading commissions, and no familiar farms—all these mechanics are aimed at long-term profitability for liquidity providers and attracting tokens to popular pools.

Subscribe and never miss a thing from the world of Tezos!

- Telegram channel

- Twitter in Ukrainian

- Twitter in Russian

- Twitter in English

- YouTube channel

- hub at ForkLog