Kvadrat.finance Explained: Profit Squared from Holding tzBTC

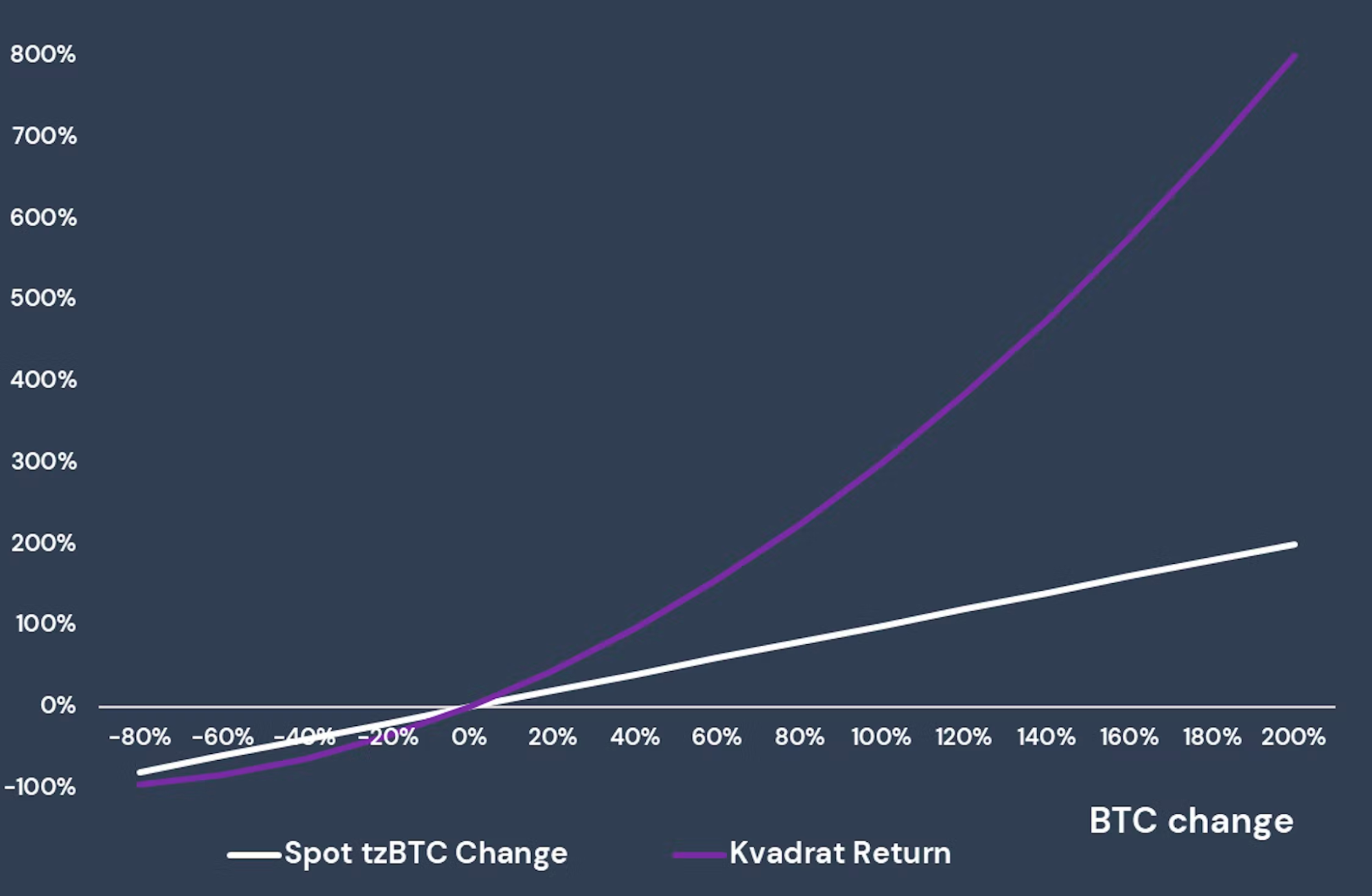

Kvadrat is a speculative open-ended tool from the developers of the Kord.fi trading service. Kvadrat provides users with long tzBTC positions with an exposure squared. Literally: if tzBTC rose twice, the position holder would earn four times as much.

Kvadrat is quite complicated, so we will explain how it works and where the profit comes from without many big words.

How Kvadrat works

Kvadrat.finance is now available on Ghostnet. To try out long buy, short sell, and liquidity pooling, you need tzBTCs for testing. These can be requested via the Kord.fi team’s Discord or Telegram.

Kvadrat uses two tokens: the wrapped bitcoin tzBTC and the kvBTC token.

Kvadrat is based on the Checker contract, on which ctez also runs. It regulates the supply of kvBTC and its price in the tzBTC/kvBTC liquidity pool.

Kvadrat regularly receives the BTCUSD price from centralized exchanges and adjusts the tzBTC² price (hence the Kvadrat in the name, which means “square” in many languages) and the kvBTC rate in the pool based on it. When the BTC price rises, the kvBTC rate rises squared. At the same time, the contract continually decreases the kvBTC price in the pool daily to thereby realize a funding rate payout from long position holders in favor of short position holders.

There are also several ways to generate passive income on Kvadrat. The first is by shorting the kvBTC token to get a daily funding rate. A sideways market can generate significant profits, even triple-digit APY. The second is minting the tzBTC/kvBTC pool’s LP tokens to earn trading fees.

Active trading on Kvadrat comes down to opening long and short positions.

Long. A user bought kvBTC for tzBTC. BTC went up, and kvBTC in tzBTC/kvBTC pool went up squared. The user exchanged kvBTC for more tzBTC than he invested.

Short. The user minted kvBTCs against tzBTCs and immediately sold them in the pool for tzBTCs. BTC and tzBTC/kvBTC exchange rates went down. The user bought back the required amount of kvBTCs from the pool, burned them, and took back the previously pledged tzBTCs. The profit was the difference between selling and purchasing kvBTC in tzBTC.

Kvadrat’s advantages over regular decentralized futures

The main advantage is that thanks to the pool’s price-adjustment algorithm, a long position on Kvadrat cannot be liquidated. Of course, if the BTC price falls, kvBTC holders will incur unrealized losses, but they will maintain their position partially.

The second advantage is in the opportunities for getting passive income. KvBTC miners and liquidity providers for the tzBTC/kvBTC pool will receive pool funding rates and trading commissions.

The third advantage is that Kvadrat does not issue profits with tokens printed out of thin air. The income of long position holders is secured by tzBTC, and the amount of actual profit realized will depend on the available liquidity in the pool.

A user with a long position of 0.0001 tzBTC will have his profit squared, but a user with a long position of 10 tzBTC selling kvBTC will see his rate drop and possibly even make a loss. Just like a real world — you need liquidity to trade big.

Just look at the screenshot: with a positive P&L of 0,1114 tzBTC (bottom left), when closing position and selling kvBTC, we will receive only 0,0995 tzBTC (right).

How to use Kvadrat

Developers emphasize three prominent cases:

- Speculation: exposure squared without liquidation risk allows you to earn more and be safer than with moderate leverage on CEX. The key is not to hold a position too long so that the funding rate does not eat up profits;

- Hedging: a long position on Kvadrat may counterbalance the risk of volatile losses when depositing tzBTC in liquidity pools, in particular in Sirius DEX;

- Yield farming: earning trading commissions and funding rate allows you to make good returns in a bear market and accumulate tzBTC.

If you want to know more about other strategies to use Kvadrat, the short position liquidation mechanism, and the funding rate formula, have a look at the Kvadrat documentation.

Conclusion

At CEX, bulls typically hold tokens for a long time in the hope of growth, while bears look for opportunities to sell quickly with leverage. Kvadrat, on the other hand, rewards bulls for quick trades and bears for long position holding.

We are happy to see more and more projects emerging on Tezos to replace centralized tools and attract more users to DeFi. We are looking forward to the launch of Kvadrat on the mainnet and the new Kord.fi projects.